Ever landed in paradise only to find your luggage decided to take a detour? Yeah, us too. And if you’ve ever spent hours on hold with customer service trying to figure out how to get reimbursed for that lost suitcase of swimsuits and sunscreen, you know the baggage insurance claim process can feel like navigating an airport during peak holiday season—chaotic and stressful.

In this guide, we’ll walk you through everything you need to know about filing a claim for baggage insurance. You’ll learn why it matters (spoiler: peace of mind is priceless), step-by-step instructions for the claim process, insider tips, real-life examples, and answers to frequently asked questions. Let’s dive in!

Table of Contents

- Why Baggage Insurance Matters

- Step-by-Step Guide to the Claim Process

- Tips & Best Practices for Smooth Claims

- Real-World Examples of Successful Claims

- FAQs About the Claim Process

Key Takeaways

- Baggage insurance protects more than just your belongings—it shields your travel experience from stress.

- The claim process involves documentation, deadlines, and communication with insurers.

- Preparation is key: Know what to pack, photograph, and keep receipts for.

- Avoid rookie mistakes like ignoring policy terms or missing deadlines.

Why Baggage Insurance Matters

Picture this: You arrive at your dream destination after months of planning, only to discover that your suitcase has gone MIA. No clothes, no toiletries, no electronics—just you and a carry-on full of snacks. Sounds like a nightmare, right?

This isn’t just bad luck; it’s a common issue. According to SITA’s 2023 baggage report, airlines mishandled over **19 million bags** worldwide last year alone. That’s roughly one bag per every 158 passengers! Without proper coverage, replacing these items—and dealing with the disruption—falls squarely on your shoulders.

Optimist You: “Baggage insurance saves the day!”

Grumpy You: “Ugh, fine—but only if coffee’s involved while I file that paperwork.”

Step-by-Step Guide to the Claim Process

Step 1: Report Your Lost Bag Immediately

The clock starts ticking as soon as you realize your luggage is missing. Head straight to the airline’s baggage service desk (or use their app) to report the loss. Get a Property Irregularity Report (PIR)—this document is golden when filing your claim.

Step 2: Gather Evidence

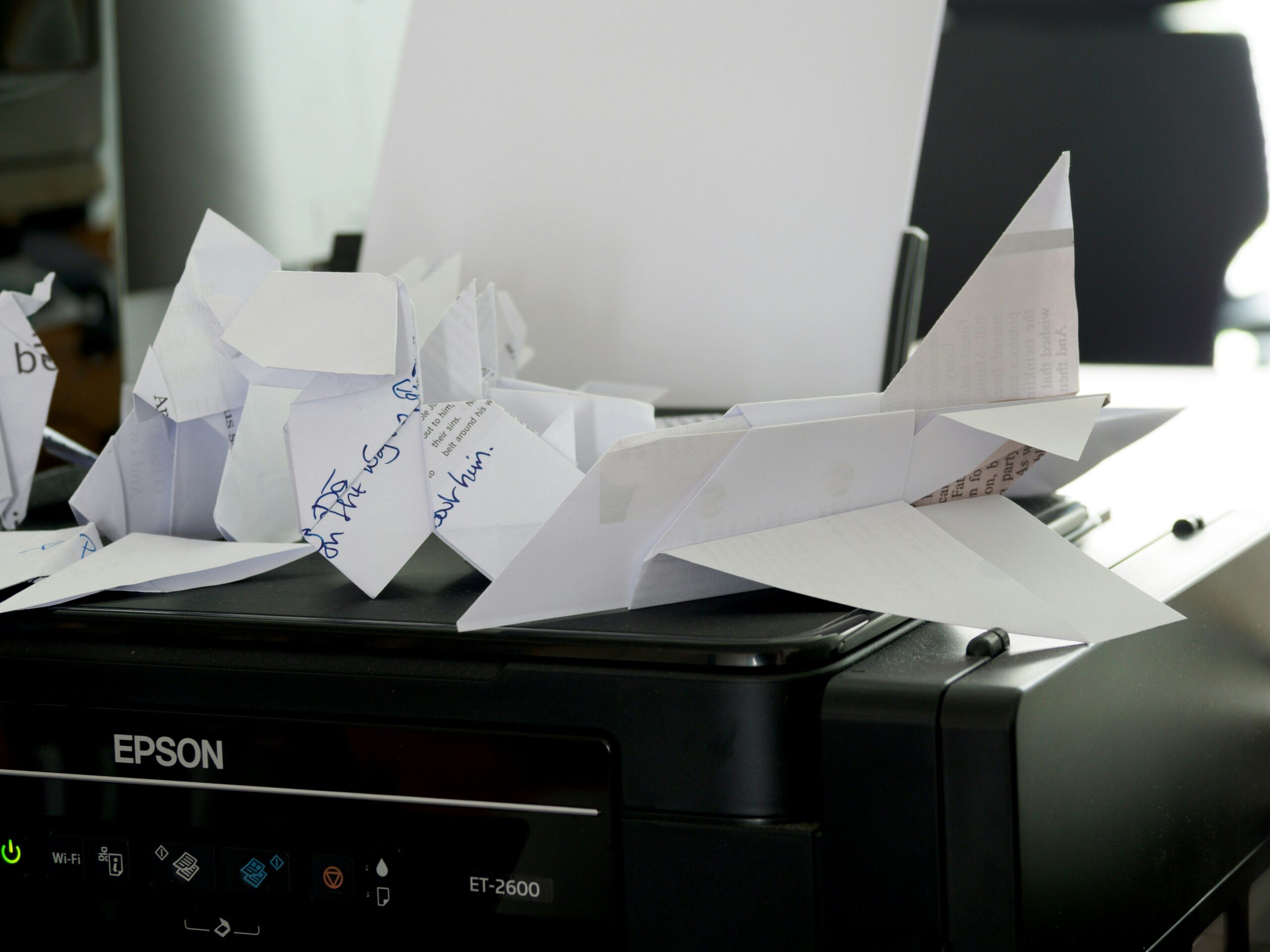

Photographs are worth a thousand words—or dollars, in this case. Snap pictures of any damaged items or empty spaces where your belongings should be. Keep all receipts for emergency purchases made due to the delay.

Step 3: Contact Your Insurer

Notify your insurer within the timeframe specified in your policy (usually 24–72 hours). Provide them with copies of the PIR, photos, and receipts. If they have an online portal, upload everything there for speedier processing.

Step 4: Submit Documentation

Fill out the claim form thoroughly. Include details about the incident, itemized lists of lost/damaged goods, and proof of value (e.g., purchase receipts, credit card statements).

Step 5: Stay Proactive

Follow up regularly via email or phone. Insurers are notorious for dragging their feet, so don’t let your claim gather dust in someone’s inbox.

Tips & Best Practices for Smooth Claims

- Pack Smart: Label your luggage prominently and avoid packing fragile/expensive items in checked bags.

- Document Everything: Before leaving home, snap photos of packed suitcases and high-value items inside.

- Read Fine Print: Understand exclusions like prohibited items or time limits.

- Stay Organized: Keep copies of all correspondence with airlines and insurers.

Rant Alert: Why do some policies make exclusions sound like they were written by a cryptic crossword puzzle designer? Ugh.

Real-World Examples of Successful Claims

Example #1: Sarah traveled to Bali with her wedding dress tucked safely in her suitcase. When the bag went AWOL, she submitted a claim supported by photos of the gown and her original receipt. Within two weeks, she received full reimbursement thanks to her meticulous documentation.

Example #2: Mark flew internationally and found his camera gear crushed upon arrival. By providing repair quotes and before/after photos, he successfully recouped $2,500 under his baggage insurance plan.

“Chef’s kiss” for drowning algorithms? These success stories prove preparation pays off big-time.

FAQs About the Claim Process

What documents do I need for the claim process?

You’ll typically need a Property Irregularity Report, photos of damaged/lost items, receipts, and a completed claim form.

How long does the claim process take?

It varies but often takes 4–6 weeks. Expedited claims depend on how quickly you submit complete documentation.

Will my credit card cover baggage issues?

Some premium cards offer limited coverage. Always check your cardholder agreement before relying solely on this option.

Conclusion

Filing a baggage insurance claim process doesn’t have to feel like decoding ancient runes. With the right preparation, evidence, and persistence, you can navigate the system smoothly and secure the compensation you deserve. Remember, the goal of baggage insurance isn’t just financial reimbursement—it’s protecting your peace of mind.

Now go forth and travel confidently, knowing you’re prepared for whatever turbulence comes your way.

Like a Tamagotchi, your claim process needs daily care. 🐣✨

Let me know if you’d like further adjustments!