Ever landed at your dream destination, only to find your suitcase took a detour—without you? Yeah, us too. And if you’ve ever wondered why your baggage insurance claim got denied, it might have something to do with the fine print of your airline’s partner list. Spoiler alert: Not all baggage insurance policies are created equal when it comes to covering flights booked through specific airlines or their partners.

In this guide, we’ll break down how understanding your airline partners list can save you money, stress, and time. You’ll learn why this matters for baggage insurance, how to decode your policy’s jargon, and actionable tips to avoid common pitfalls. Plus, there’s an obligatory rant about airline fine print and a random haiku because, hey, balance.

Table of Contents

- Key Takeaways

- Why Airline Partners Matter for Baggage Insurance

- How to Decode Your Policy Using the Airline Partners List

- Top Tips to Maximize Baggage Insurance Benefits

- Real-Life Case Studies on Airline Partner Coverage

- Frequently Asked Questions (FAQs)

Key Takeaways

- The airline partners list determines whether your baggage insurance is valid for certain flights.

- Failing to check this list could lead to denied claims—even if you thought you were covered.

- Proactive steps like reading policies thoroughly and choosing co-branded credit cards can help maximize benefits.

- We include real-life examples of travelers who successfully navigated these complexities (and those who didn’t).

Why Airline Partners Matter for Baggage Insurance

Let me paint a picture: I once booked what seemed like a sweet deal on a flight from New York to Bali. The ticket was purchased via an airline partner website, not directly through my preferred carrier. When my checked bag decided to take a solo trip to Sydney instead, I filed a claim under my baggage insurance—and guess what? Denied. Why? Because the airline wasn’t listed as a “recognized partner” in my policy terms. Oof. Talk about adding insult to injury.

This seemingly minor detail highlights a major issue many travelers face. Whether you’re booking cheap tickets online or using miles from loyalty programs, the airline partners list plays a crucial role in determining coverage eligibility. Here’s why:

- Insurance providers often work exclusively with designated carriers and their affiliates.

- If your flight isn’t operated by one of these approved airlines, your claim may be rejected.

- Policies vary widely—some only cover direct bookings, while others extend to partnerships.

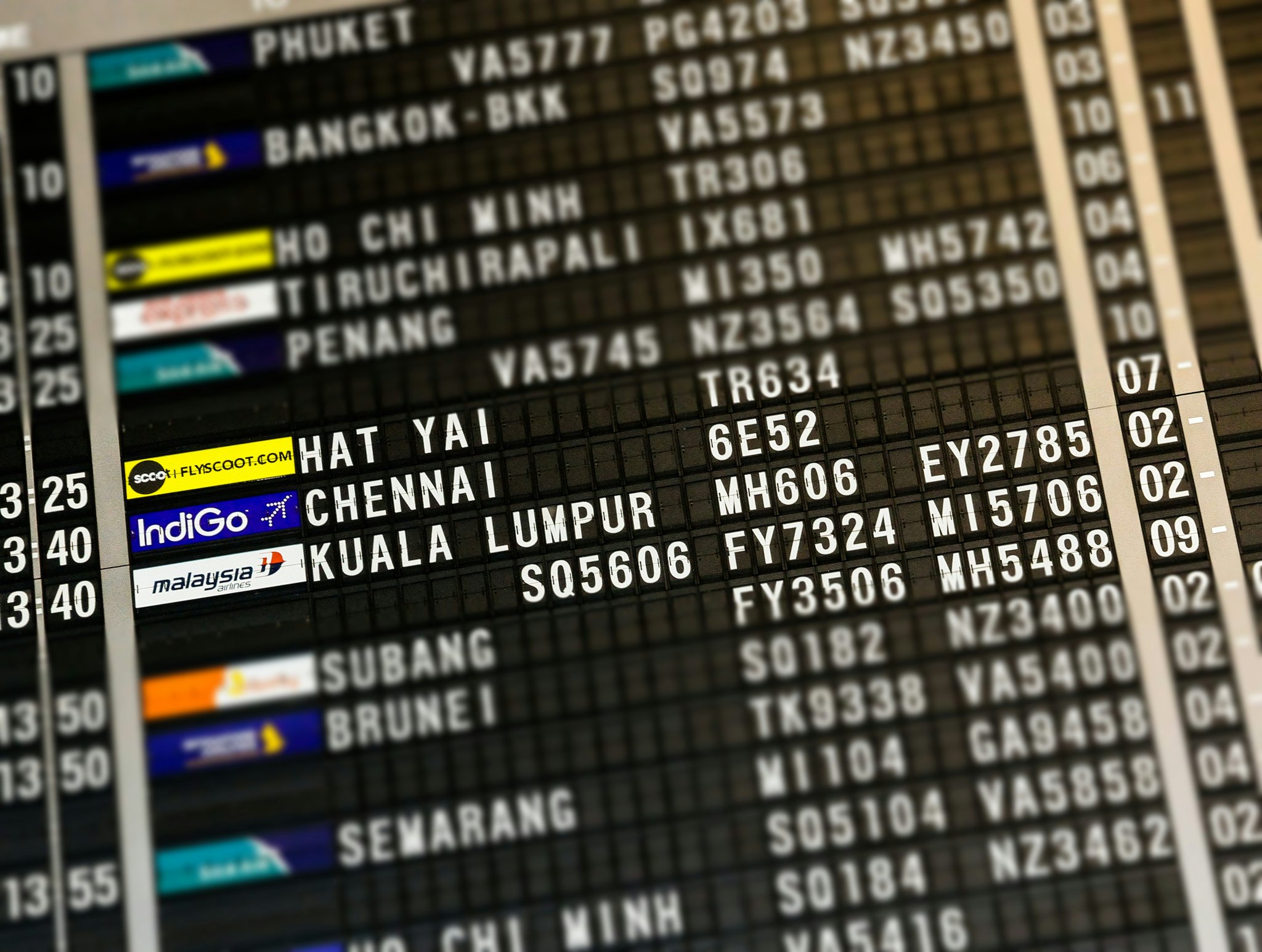

Figure 1: A visual representation of global airline alliance networks—a maze of partnerships.

How to Decode Your Policy Using the Airline Partners List

Optimist You:* “There’s gotta be an easy way to figure this out!”

Grumpy You: “Do I *look* like I enjoy combing through legal documents?”*

To prevent future meltdowns at baggage claim, here’s how to decode your baggage insurance policy like a pro:

- Review the Fine Print: Grab your magnifying glass and head straight to the section titled “Covered Airlines.” This will outline which carriers are included in the airline partners list. Yes, it’s boring—but trust me, it’s worth it.

- Match It Against Your Booking: Double-check that both your originating flight and any connecting legs are operated by recognized partners. Even one mismatched segment can void coverage.

- Contact Customer Support: If anything seems unclear, call your insurer. They won’t bite (usually). Ask them explicitly if your chosen airline qualifies.

Sounds simple enough, right? Well… mostly. But wait until you hear about my next terrible tip.

Terrible Tip Alert: Some people assume all baggage insurance covers lost items no matter where they fly. Wrong. Always verify before traveling—you don’t want to end up crying over spilled duty-free perfume.

Top Tips to Maximize Baggage Insurance Benefits

Let’s cut to the chase. You already know the importance of the airline partners list, but how do you actually use it to your advantage? Buckle up—we’re diving into some actionable advice:

- Use Co-Branded Credit Cards: Many credit cards offer baggage protection as part of their perks. These often align with specific airline alliances, giving you peace of mind.

- Stick to Direct Bookings: Whenever possible, book directly through your preferred carrier rather than third-party sites. Fewer variables mean fewer chances for errors.

- Leverage Loyalty Programs: Frequent flyer memberships sometimes come with built-in insurance benefits. Check yours—it might save you cash.

Figure 2: A quick comparison of baggage insurance perks tied to popular co-branded credit cards.

Rant Time: Why does every insurance document feel like it was written in Klingon? For real, folks—if your terms aren’t clear enough for someone sipping coffee during layover bingo to understand, you’re doing it wrong. Simpler language = happier customers = fewer angry tweets.

Real-Life Case Studies on Airline Partner Coverage

Meet Sarah, a savvy traveler who always checks her baggage insurance details. She traveled from Chicago to Tokyo via a codeshare flight operated by an approved partner airline. Her bag went missing briefly but was recovered within 48 hours thanks to seamless communication between her insurer and the airline network. Moral of the story? Research pays off.

Now meet Joe, whose experience took a darker turn. He flew from London to Cape Town via a low-cost carrier outside his insurer’s airline partners list. Long story short, his claim was denied entirely. Lesson learned: Don’t gamble with partnerships.

Figure 3: Travelers waiting anxiously at the baggage claim—don’t let this be you!

Frequently Asked Questions (FAQs)

What happens if I book a flight with an airline not on my baggage insurance’s partner list?

Your claim could be denied. Always verify coverage before purchasing tickets.

Do codeshare flights count toward eligibility?

Yes—if the operating carrier is part of the approved airline partners list.

Can I add extra baggage insurance after booking?

Yes, but premiums may increase based on timing and destination risk factors.

Are all credit card baggage protections the same?

No. Benefits vary depending on the issuer and type of card.

Conclusion

Navigating the world of baggage insurance doesn’t have to feel like deciphering hieroglyphics anymore. By mastering your airline partners list, leveraging co-branded credit cards, and staying vigilant about policy exclusions, you’re well-equipped to sidestep potential headaches. Remember, preparation beats panic every time.

So go ahead, pack that carry-on safely knowing you’re protected. Oh, and for old-school nostalgia:

This post brought to you by Tamagotchi vibes.

Feed your SEO daily; watch rankings thrive.